NEWS

2/8/2018

Controversial taxation rules amendment effective since June

A taxation rules amendment adopted with the aim to transpose into the national legislation the European Directive DAC 5 entered into effect on 5 June 2018. The purpose of the Directive is to ensure that, in performing international tax administration, Member States’ tax administrators have access to certain client data in the possession of banks, payment services providers, lawyers and other professional chamber members as required by the anti-money laundering law. However, the amendment goes beyond the scope of the transposition by ordering banks, insurance companies and payment services providers to provide client data to tax administrators also within the scope of a tax procedure on a national level. Opponents of the amendment consider this requirement as breach of bank secret and client privacy. The amendment had been rejected by the Senate in April. However, the Chamber of Deputies outvoted the Senate with 123 votes for the amendment.

The proposal according to which the requirement to provide information to the data administrator should apply also to lawyers, notaries and tax advisers has not been adopted finally, due to strong criticism from certain political parties and the general public. As far as the lawyers and other professional chamber members are concerned, the confidentiality duty is, therefore, cancelled only to the extent arising from DAC 5, i.e., for the purpose of international exchange of information in performing the duties under the Act on Certain Measures against the Legalisation of Proceeds from Crime and Terrorism Financing. That said, the requirement may apply to information from the area of trust or escrow, but not to information related to legal assistance.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

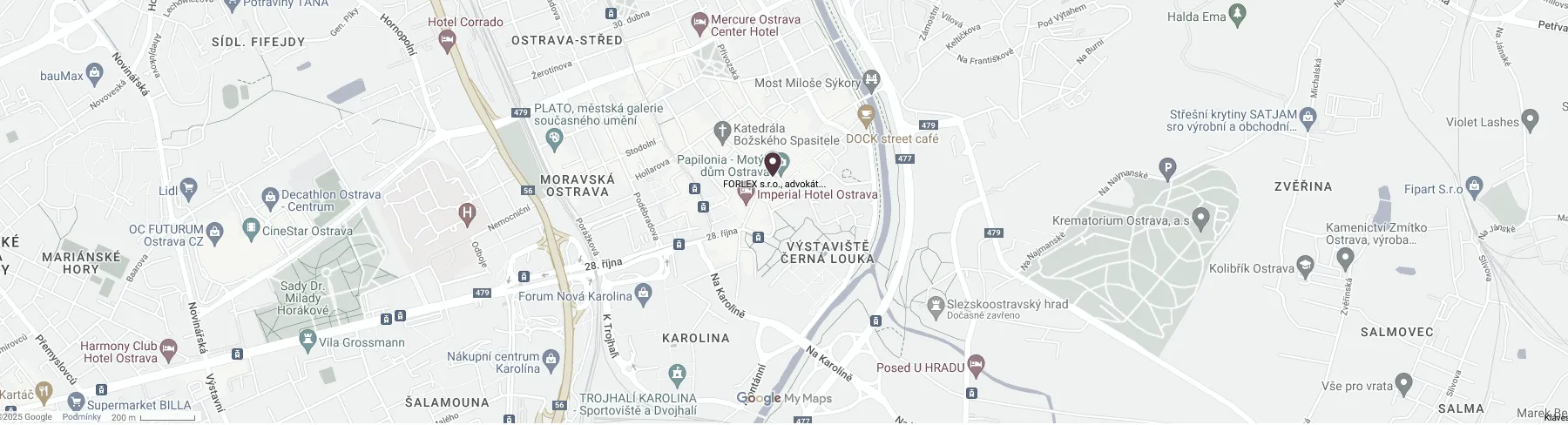

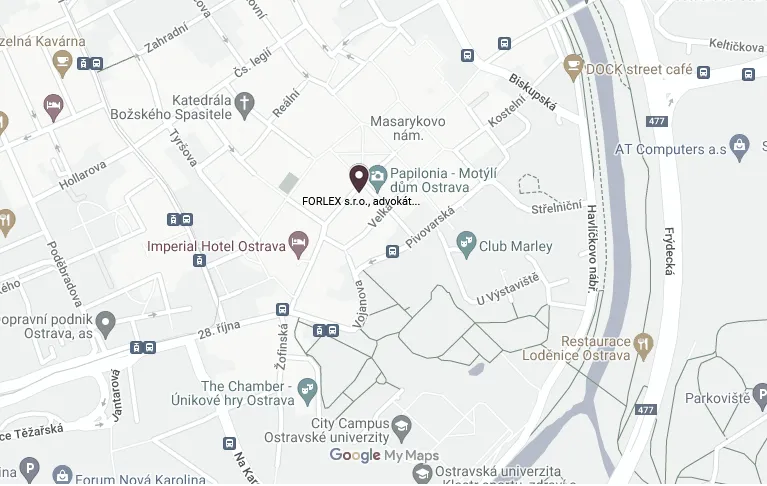

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

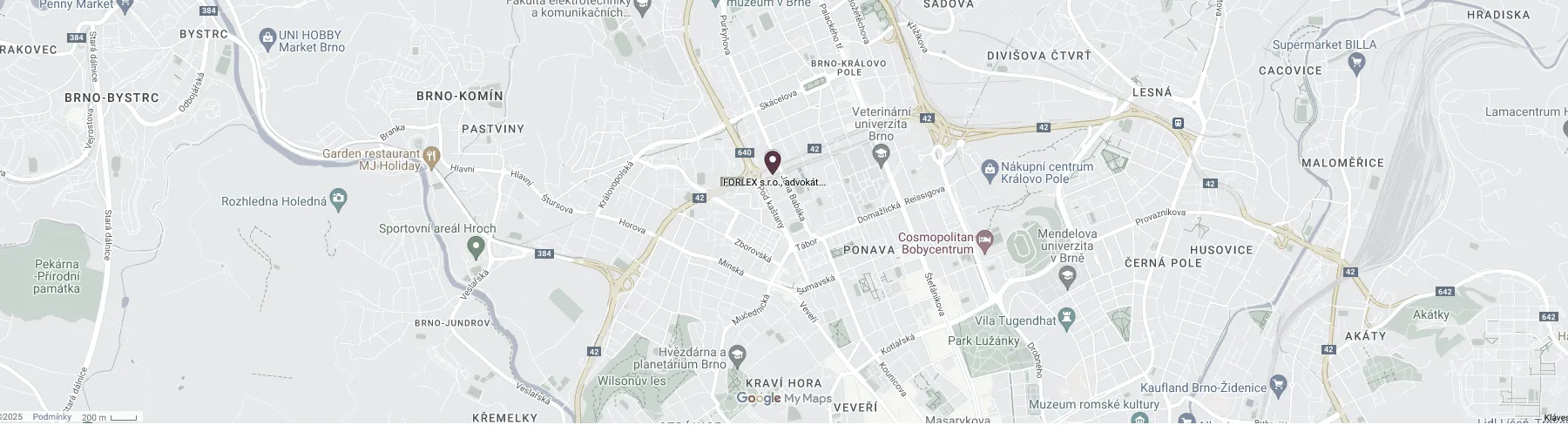

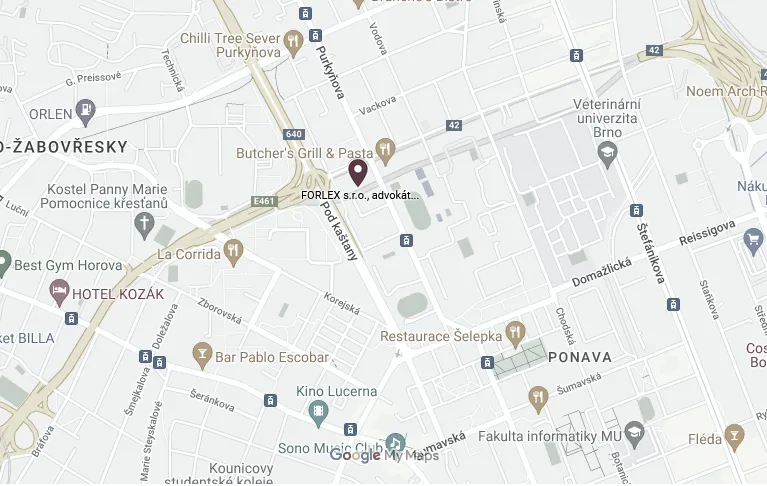

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.