NEWS

7/2/2019

The Chamber of Deputies discusses a comprehensive amendment to tax laws

The Chamber of Deputies has adopted a proposal amending certain laws in the field of taxes and customs duties. The proposal brings about amendments, inter alia, to the Income Tax Act, the Value Added Tax Act, the Excise Tax Act, the Customs Act and the Tax Code.

As for the Income Tax Act, the proposal implements the EU rules against tax avoidance practices that directly affect the functioning of the internal market. The proposal foresees, for example, to limit the deductibility of exceeding borrowing costs (interest), by (i) introducing a limit on the deductibility of exceeding borrowing costs only up to 30 percent of EBITDA, or CZK 80 million, which can lead to a considerable increase in the amount of tax paid; (ii) adjusting the tax on transfers of assets without change of ownership from the Czech Republic abroad where such transfers are to be deemed, for the purposes of income tax, transfers of assets at a price which would have been agreed between unrelated parties in the ordinary course of business under the same or similar conditions. It also intends to extend the existing notification obligation by introducing an obligation of non-resident taxpayers in the Czech Republic to notify the tax authority of payments of taxes levied on their income paid to another country, which will certainly increase the administrative burden on the taxpayer.

In relation to the Value Added Tax, one of the aims of the act is to extend the possibility of correcting the tax base in cases where there is a high probability of non-payment of a creditor’s claim. It will thus also be possible to adjust the tax base even if the claim is subject to enforcement proceedings in which it has not yet been fully recovered and at least 2 years have elapsed since the first writ of execution within the proceedings or the enforcement was terminated for the debtor’s lack of means; it will also be possible to adjust the tax base with other types of bankruptcy than bankruptcy order. Based on the related amendment to the Insolvency Act, the deduction of tax in such a case will become the tax authority’s receivable, equal to the receivables for the assets.

The law is likely to come into force in April 2019; as far as the income tax is concerned, this should happen in January 2020.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

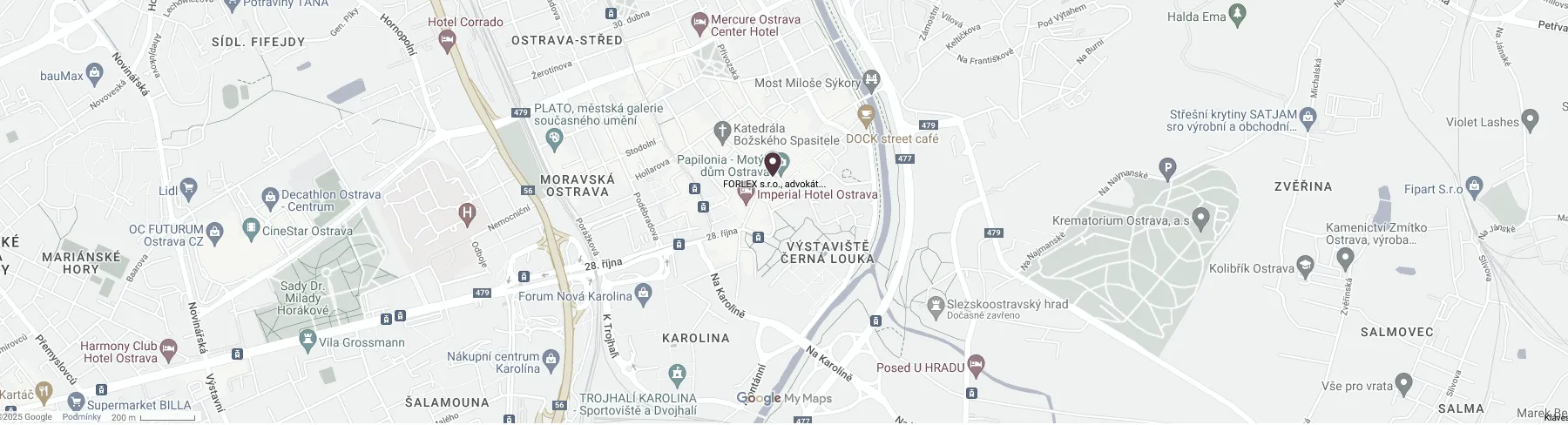

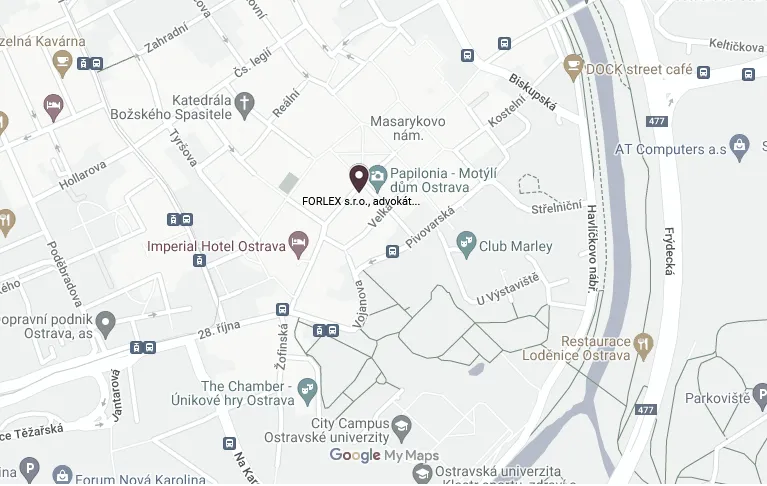

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

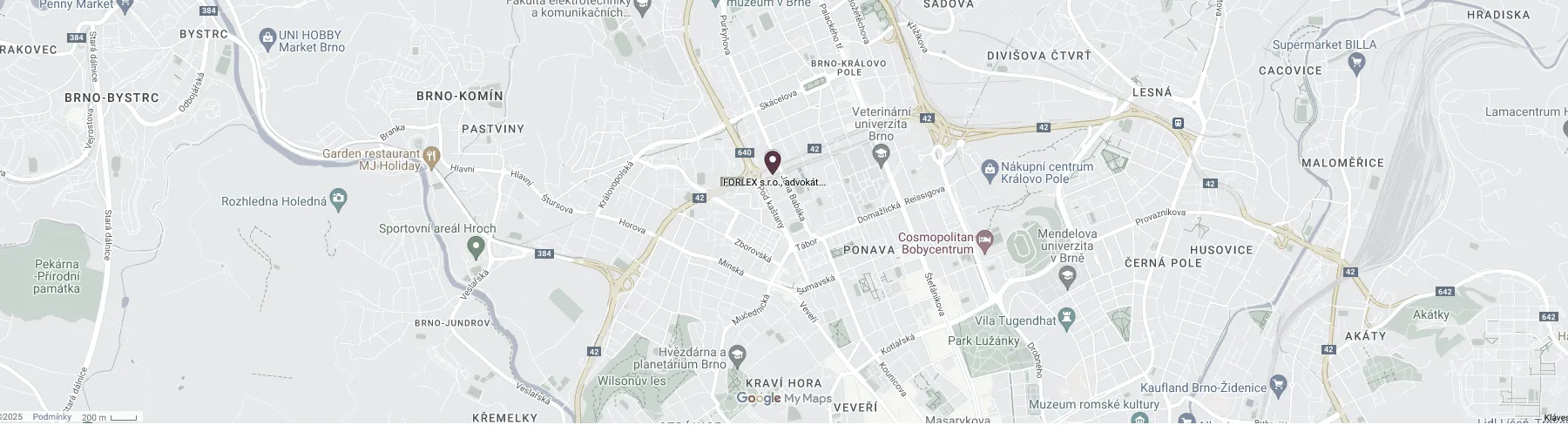

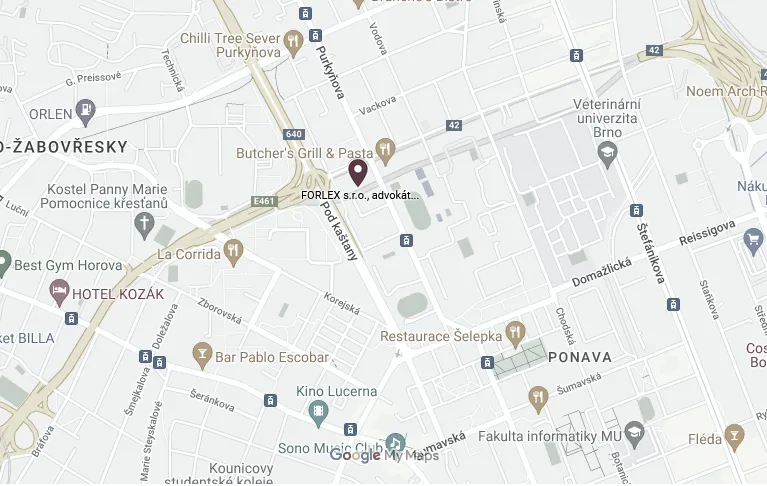

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.