NEWS

13/2/2019

Discharge procedures to become accessible for a wider range of debtors

On December 19, 2018, the Senate rejected a draft amendment to the Insolvency Act and returned it to the Chamber of Deputies for further discussion; the amendment is primarily intended to deal with the situation of indebted natural persons locked into debt-traps. The draft amendment aims to make the discharge procedure available to a wider range of debtors, for example by removing the condition to repay a minimum of 30% of the claims of unsecured creditors over a period of 5 years.

Furthermore, the proposal introduces a definition of a debtor’s dishonest intent; the debtor’s (dis)honest intent then has an impact on whether the discharge procedure is approved. A debtor’s intent will be seen as dishonest, if (i) he or she fails to mention a substantial part of his or her assets in the list of assets; (ii) he or she provides false information in the insolvency proceedings; (iii) he or she has conceals one or more of his or her incomes or fails to attempt to carry out a regular gainful activity or (iv) his or her conduct before applying for the discharge procedure is deemed to have been prejudicial to his or her creditors.

If this amendment is adopted, it is expected to become effective in the middle of this year.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

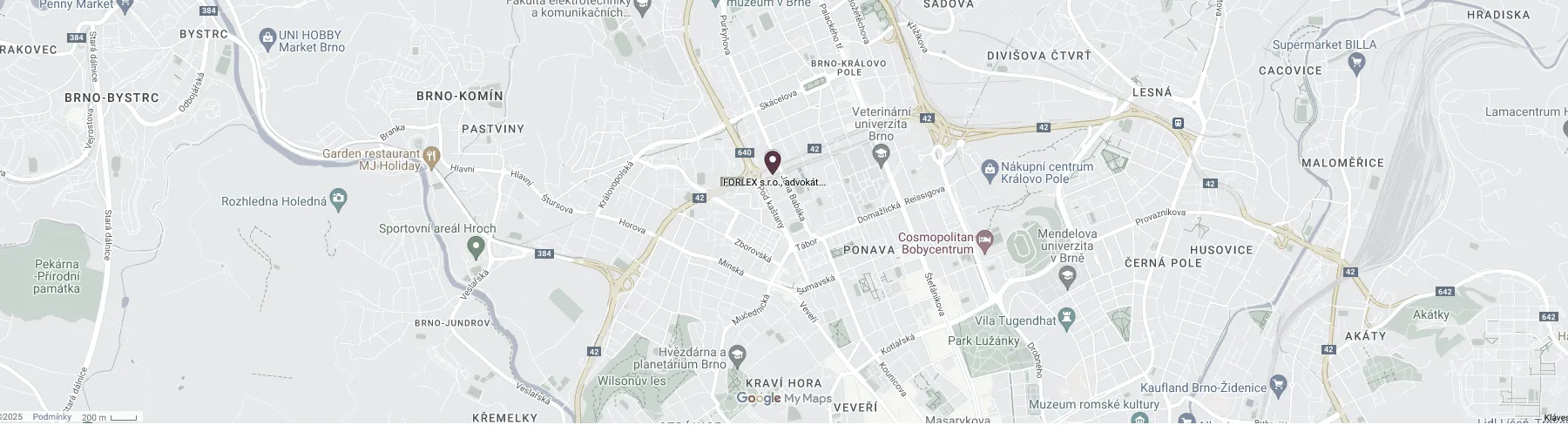

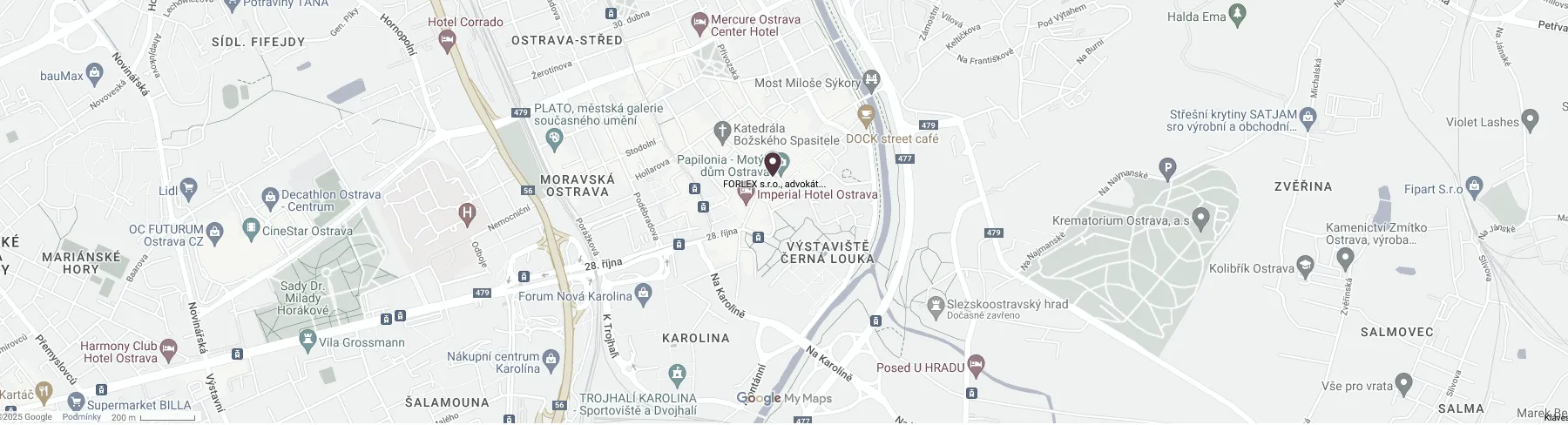

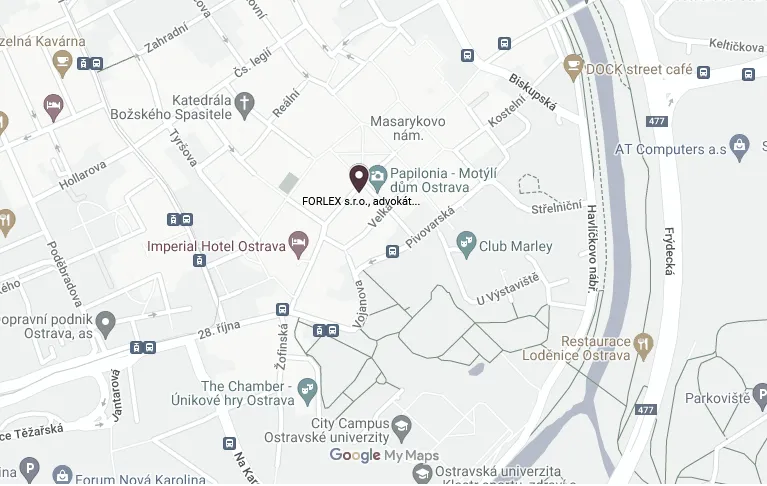

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

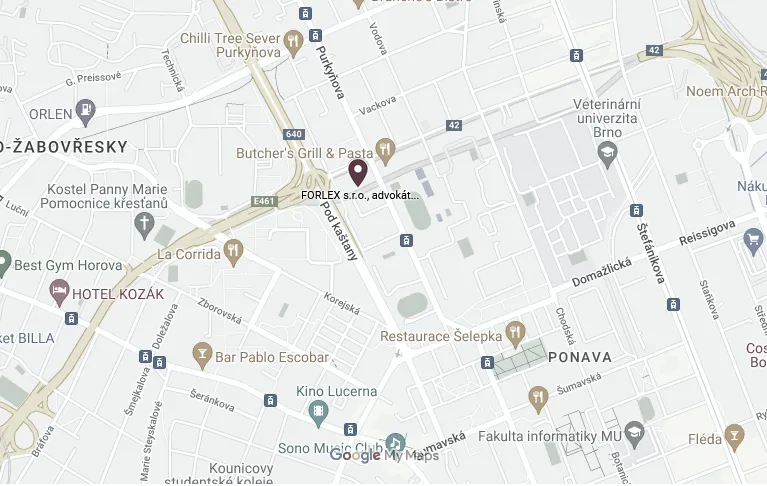

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.