NEWS

9/9/2019

Major judicial decision of the Supreme court to pay the profit in capital companies

The Supreme Court has recently issued a decision expressly surpassing the existing case-law conclusions on the General Meeting not being entitled to decide on the distribution of profits in the second half of the year based on the regular financial statements for the previous accounting period. According to the aforementioned decision, it is certain that, after the recodification of private law as of 1 January 2014, the General Meeting is entitled to decide on the distribution of profits based on regular financial statements for the previous accounting period at any time until the end of the following accounting period, provided that the company succeeds in the insolvency test under the Business Corporations Act and the payment will not result in the bankruptcy of the company.

At the same time, the Supreme Court’s decision also broke the established rule that the General Meeting may not decide on the payment of bonuses (shares of the members of the Board of Directors and the Supervisory Board in profit) without approving the payment of dividends (a share in profit to be paid to shareholders) at the same time. With effect from 1 January 2014, the General Meeting is entitled to decide on the distribution of profits so that a part of the profit is distributed among members of elected bodies (if permitted by the Articles of Association) without any payment to shareholders, and the remaining profit will be retained. However, the General Meeting may proceed in this manner and refrain from paying profits to shareholders only for important reasons, while respecting the prohibition of abuse of the majority of votes.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

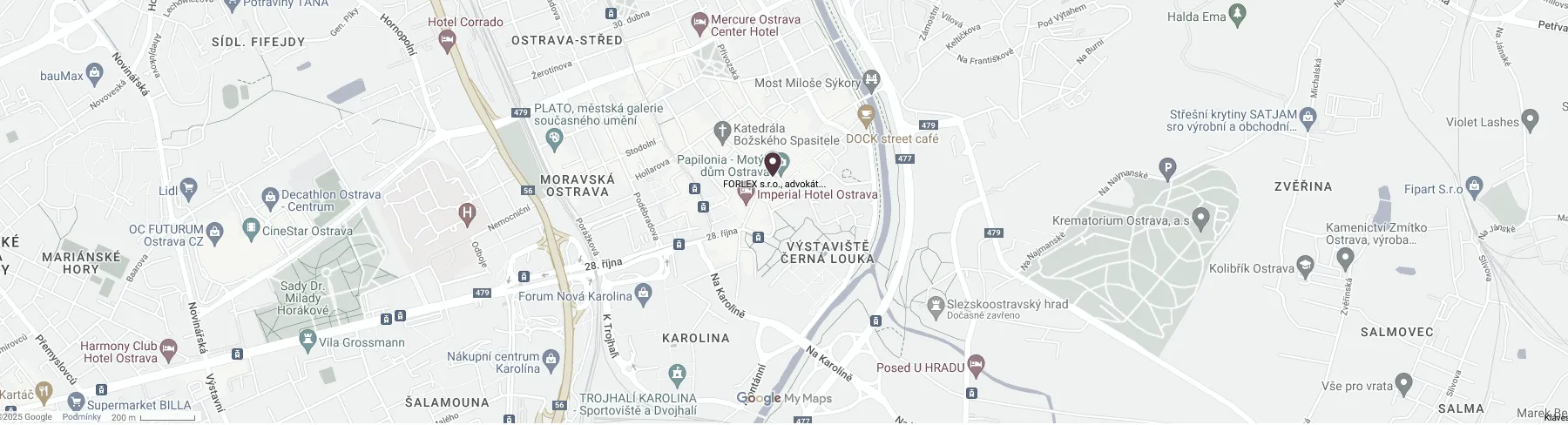

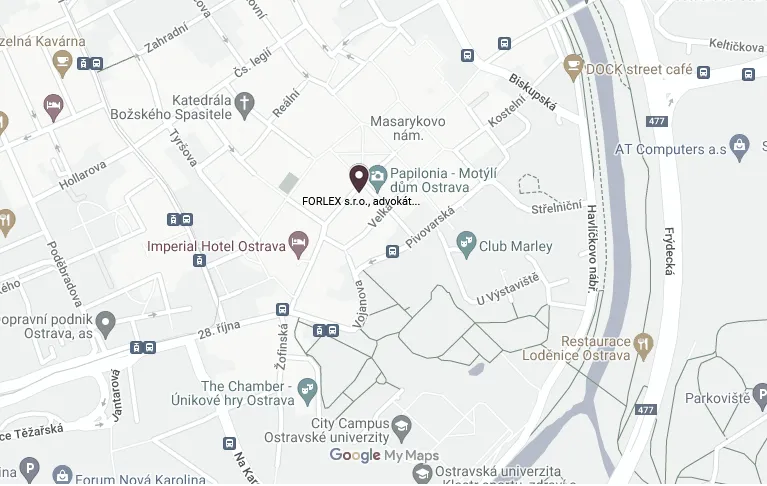

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

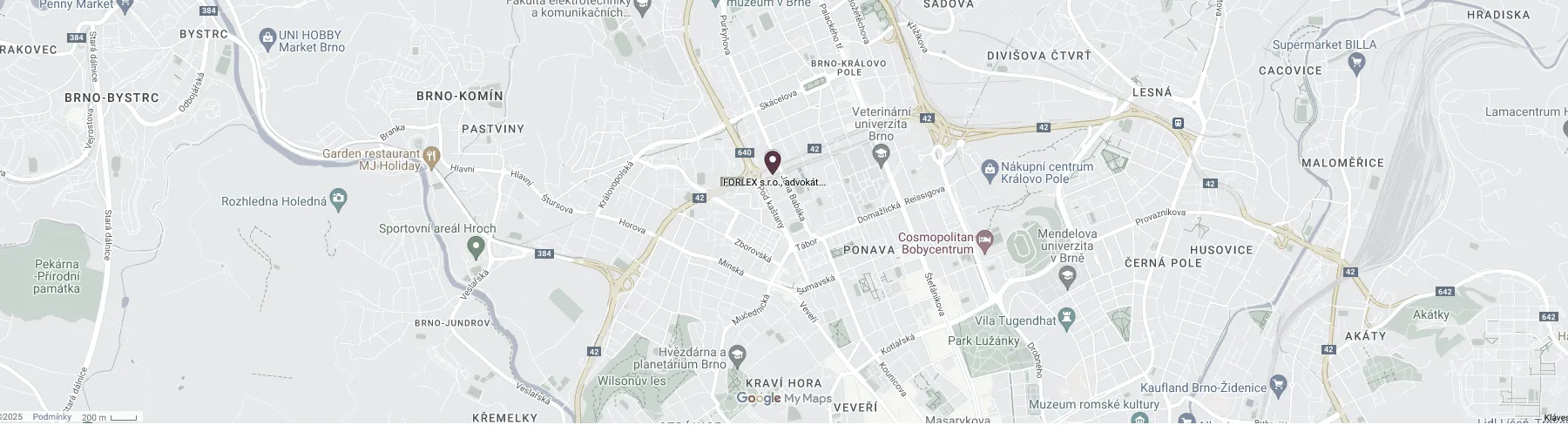

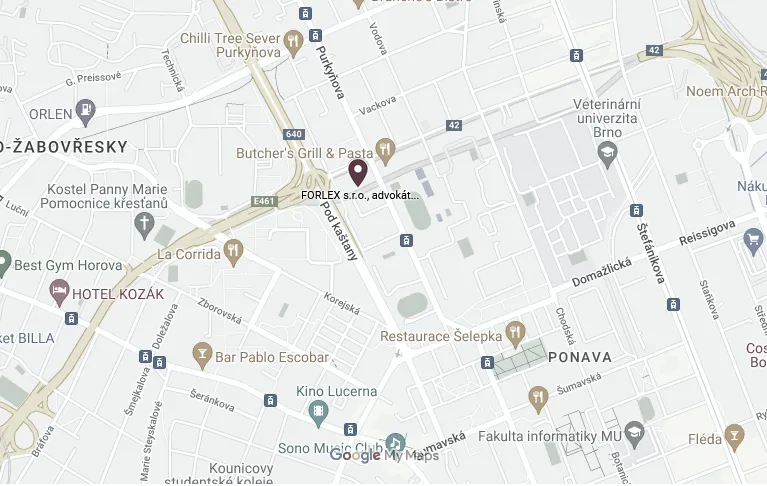

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.