NEWS

27/11/2019

Real Estate acquisition tax exemption extended to units in single-family detached houses

An amendment to the Senate’s statutory measure on the real estate acquisition tax took effect on 1 November, extending, in the case of a first-time purchase of title to a housing unit, the current exemption from the real estate acquisition tax to units in single-family detached houses. The need to enact the amendment resulted from the growing trend of creating units in newly built single-family detached houses, in particular in those areas where the development of apartment buildings is not allowed under the land-use plan. According to the current legislation, the tax relief applies, in addition to housing units, also to a first-time purchase of title to a single-family detached house.

However, housing units in single-family detached houses were not previously covered by legislation, probably because they were quite rare as their creation was usually limited to property settlement in inheritance proceedings. The amendment aims to introduce a level playing field for the exemption of units in apartment buildings and single-family detached houses, with the explanatory memorandum to the amendment explicitly setting out that the exemption for single-family detached houses should be granted irrespective of whether a share in the property or a unit is being acquired.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

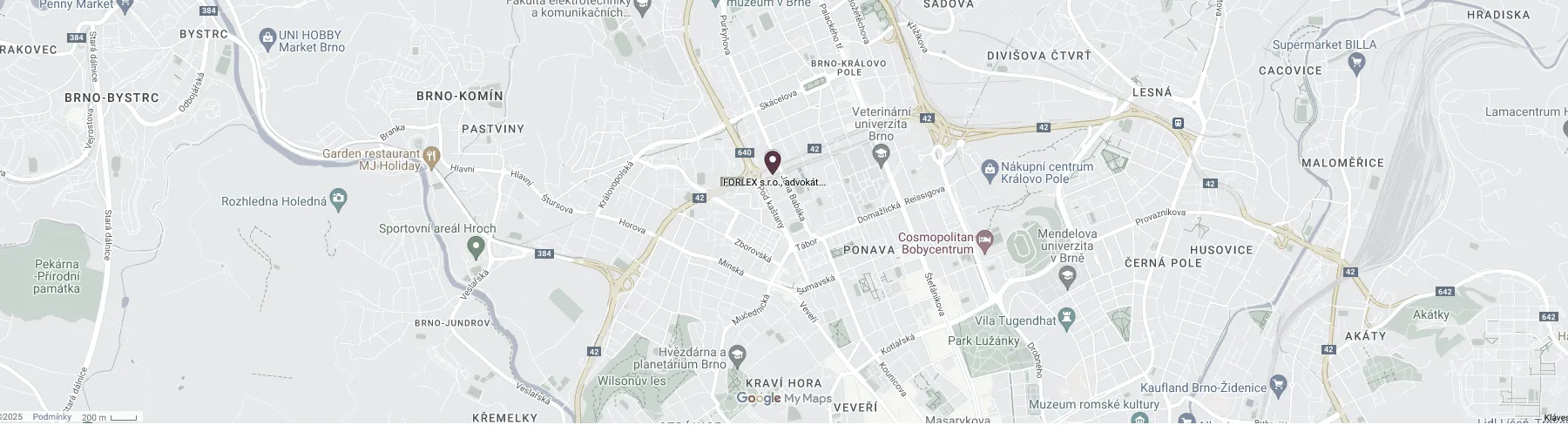

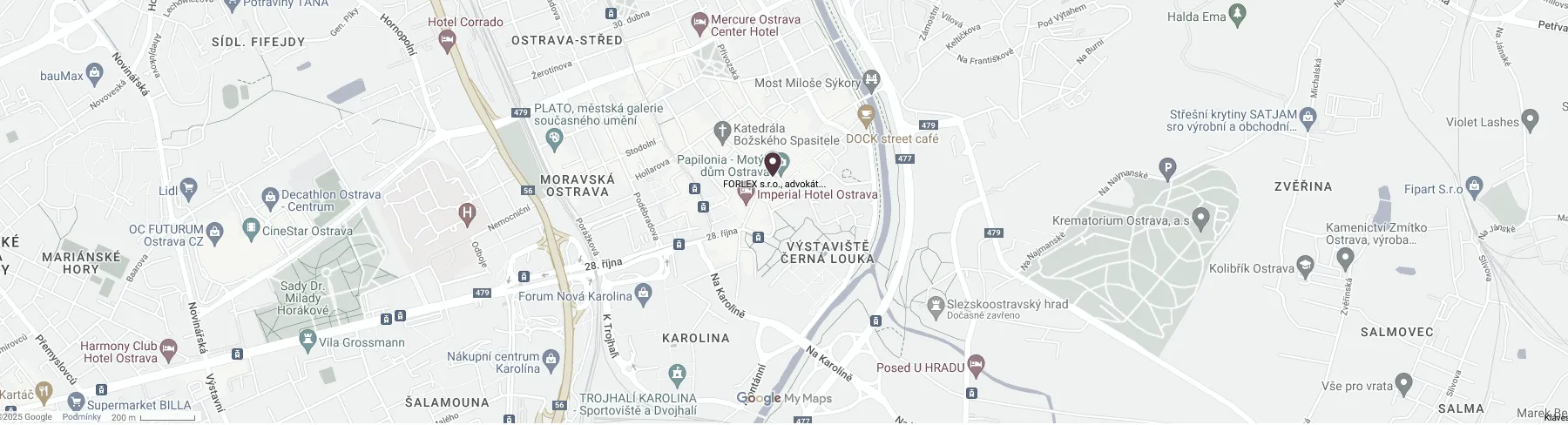

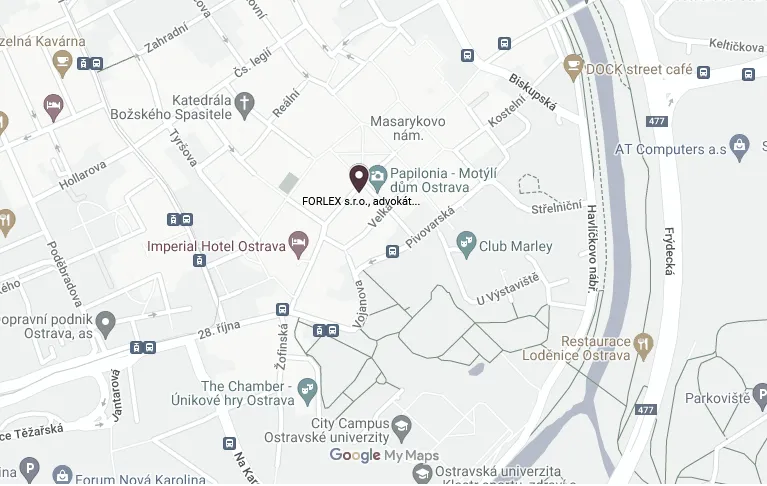

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

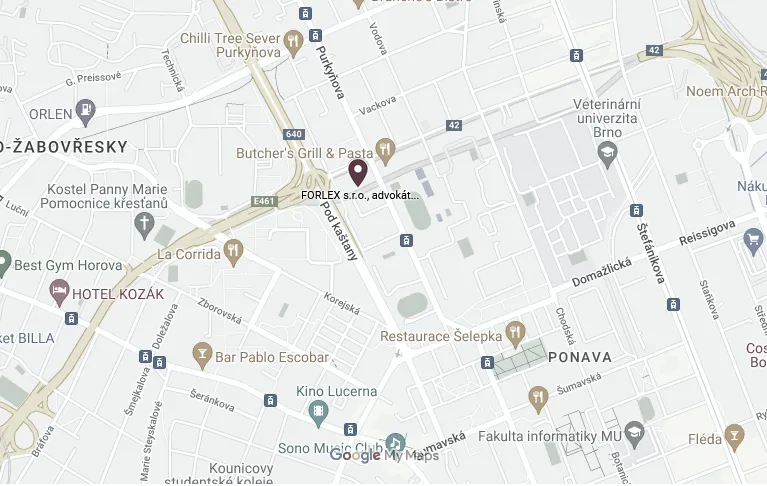

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.