NEWS

24/3/2020

COVID-19: IMPORTANT INFORMATION ON CRISIS COMPLIANCE AND GOVERNMENT ASSISTANCE OPTIONS

Dear clients,

on 19 March 2020, the European Commission adopted a temporary framework to support the economy in the context of the outbreak of the COVID-19 epidemic (the "Temporary Framework") to remedy serious disruption of the European economy. The aim of the Temporary Framework is to enable Member States to provide support to companies in financial difficulties caused by the COVID-19 epidemic as quickly as possible. The Temporary Framework will be in force until the end of December 2020 and may be extended if necessary.

The reason for this European measure is that practically any aid granted by a Member State to entrepreneurs could be considered as prohibited state aid by the European institutions in the absence of such a Temporary Framework. Public statements by governments (not only in the Czech Republic) looks, however, much more generous.

It is questionable whether, in the current situation, the EU Member States really should limit themselves by this Temporary Framework. However, it would be surprising if governments really allowed themselves to go beyond the limits of the Temporary Framework (which may be increased in the future). The Czech government have always respected European state aid rules so far. This obviously does not mean that they cannot request further exemptions from the European Commission.

Brief overview of measures under the Temporary Framework:

1. Aid in form of direct grants, repayable advances or tax advantages

Member States will be able to put in place grant schemes of up to EUR 800 000 for each company facing a sudden liquidity shortage.

2. State guarantees for bank loans

Member States will be able to provide state guarantees to ensure that banks do not stop lending to businesses that need them. The guarantee shall not exceed 90 % (in cases where losses are distributed equally between the lending institution and the State under the same conditions) and 35 % (where the losses are first credited to the State and only subsequently to the lending institution). The duration of the State guarantee is limited to six years.

3. Subsidized public loans

Member States will be able to provide loans to businesses at preferential interest rates to cover immediate operational and investment needs. The interest rate must be at least equal to the basic interest rate effective as of 1 January 2020 plus a credit risk margin corresponding to the minimum level defined by the State guarantees. Reduced interest rates can be used for six years.

4. Guarantees for banks that mediate support to the real economy

The Temporary Framework provides that, if Member States want to use the existing lending capacity of banks and use them as a business support intermediary (especially for small and medium-sized enterprises), this support is considered to be direct support to bank customers, not banks themselves.

5. Short-term export credit insurance

All types of aid have in common that they can only be granted to companies that were not in difficulty on 31 December 2019 but that faced difficulties or entered into difficulty thereafter as a result of the COVID-19 outbreak. The aid is granted no later than 31 December 2020.

Member States can now prepare support programs

Support programs will need to be set up to include and meet the conditions set out in the Temporary Framework.

Once the national plan has been approved by the Commission, Member States may grant individual aid immediately without the Commission's agreement.

Approval is very fast (e.g. for Denmark, the decision was issued within 24 hours of the Danish program being notified to the Commission).

We will gladly answer any further questions that you may have.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

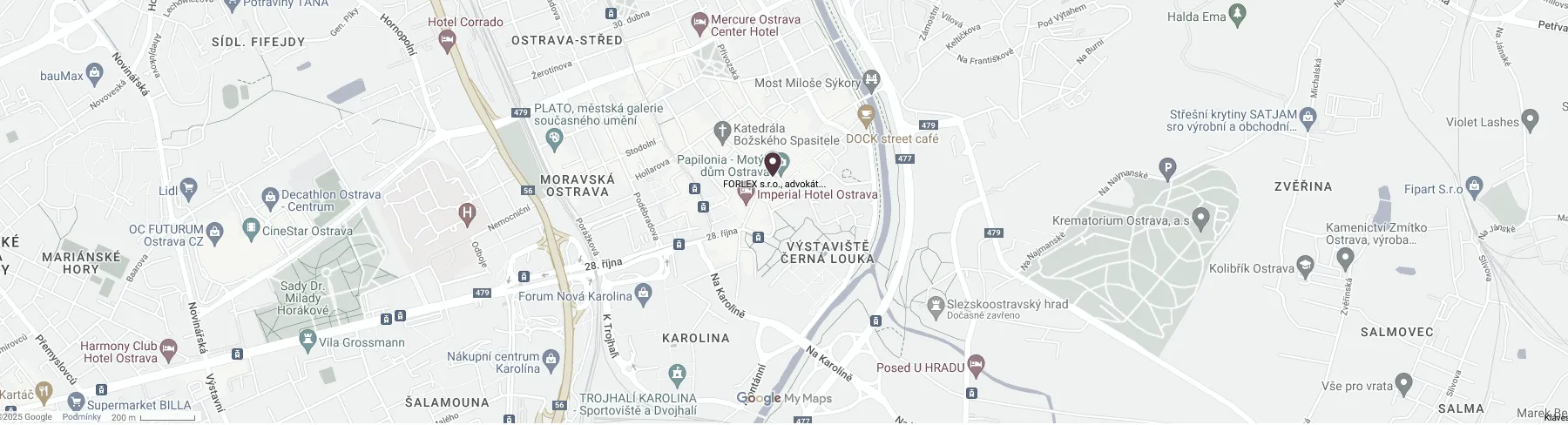

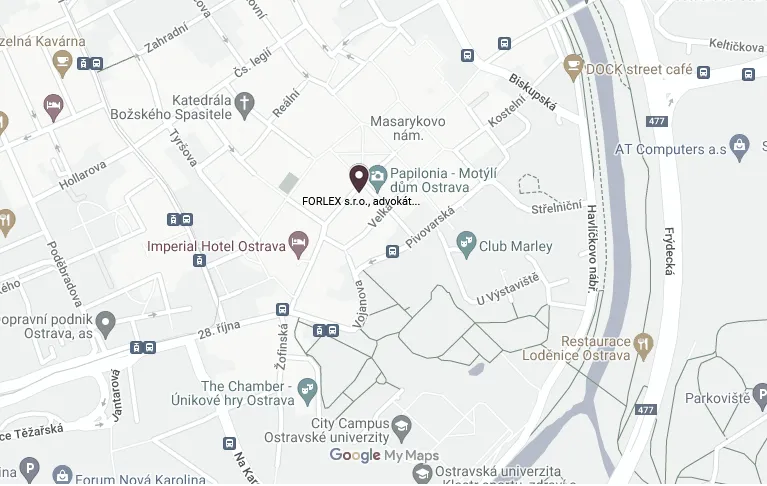

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

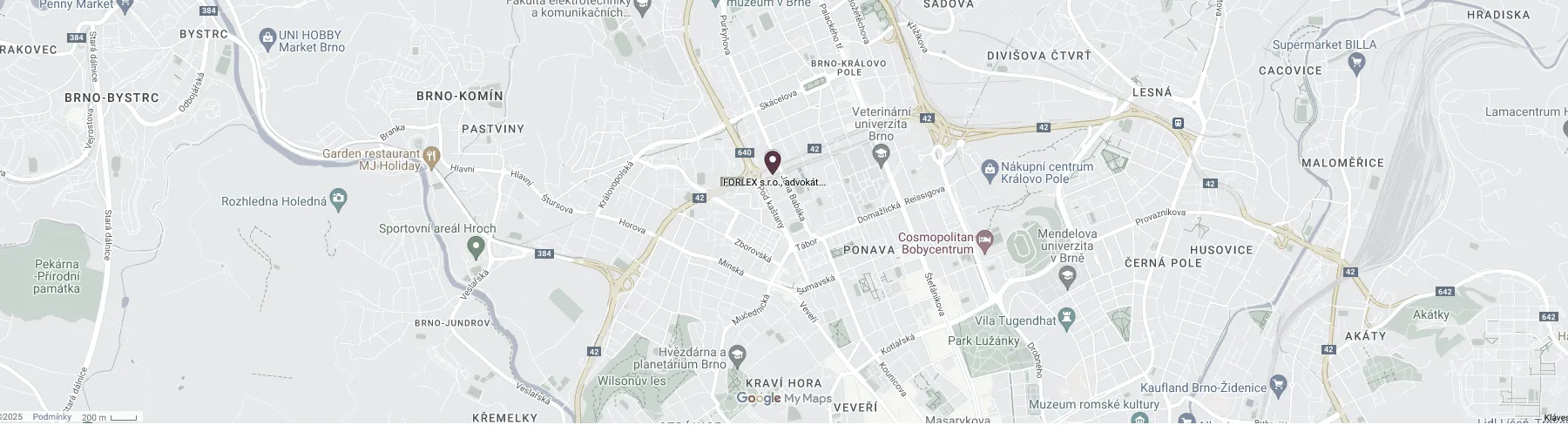

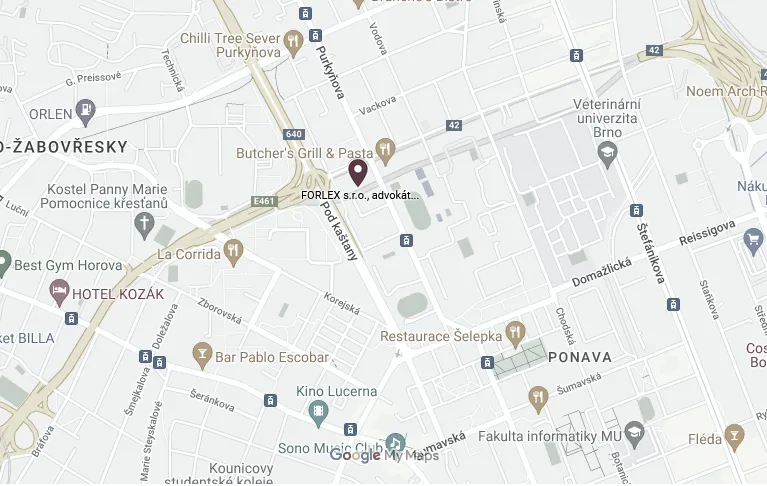

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.