NEWS

27/5/2020

CORONAVIRUS UPDATE - Antivirus extension

Dear clients,

let us briefly inform you about news within the Antivirus program.

ANTIVIRUS EXTENSION

Mode B was newly extended by a government resolution until 31 August 2020.

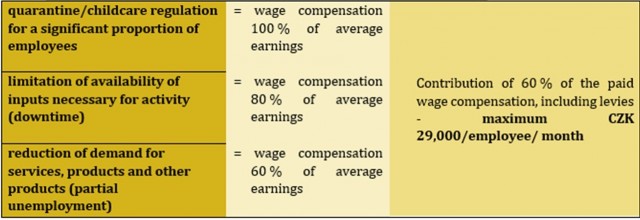

For completeness, we recall the conditions of mode B:

- obstacles according to § 207, § 208 (in part) and § 209 of the Labor Code

Mode C - for small businesses

On May 25, 2020, the government approved Mode C of the Antivirus program. This support for employers with a maximum of 50 employees should consist of the waiver of social security contributions and contributions to the state employment policy paid by the employer for the months of June, July and August 2020.

However, unlike modes A and B, the new regime C will be regulated by law. This proposal is now going to the Chamber of Deputies, and the final form can of course still change.

For the sake of completeness, it should also be noted that a distinction needs to be made between (i) the above-mentioned Antivirus Scheme C, under which payments should be waived, and (ii) the 80% penalty for late payment of social security contributions and state employment policy contributions. , which we informed you about in our latest news. It is still the case that the possibility of concurrence of both aids is not regulated in any way, and by using the already effective option of deferring levies with lower penalties, the employer can potentially deprive himself of the opportunity to draw a contribution from the Antivirus program.

In general, we recommend approaching the option of postponing / non-paying of payments for the time being rather reluctantly.

Legal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

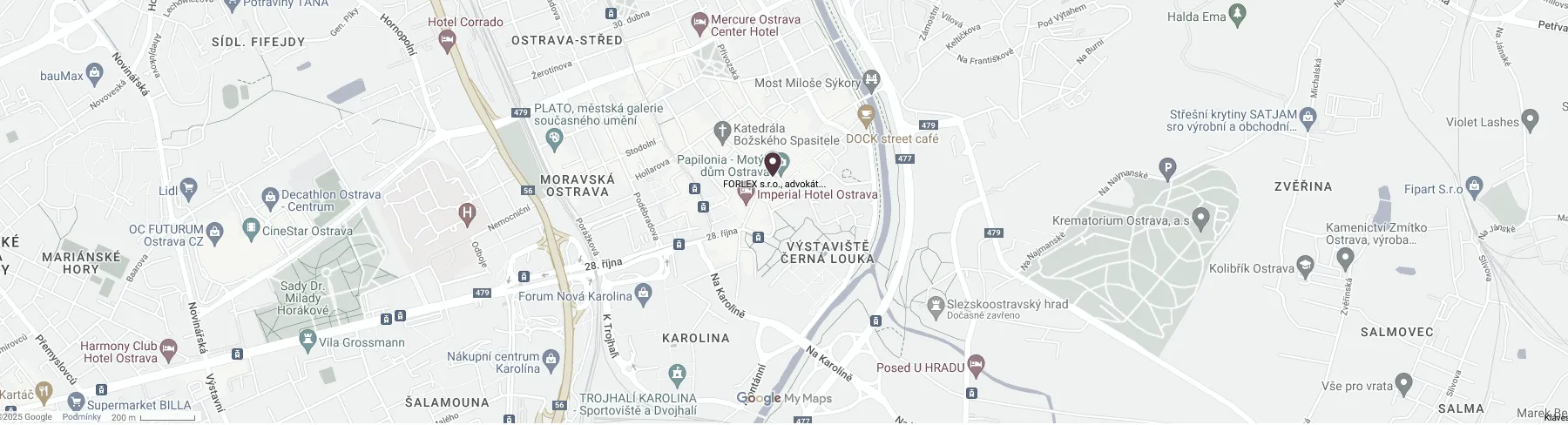

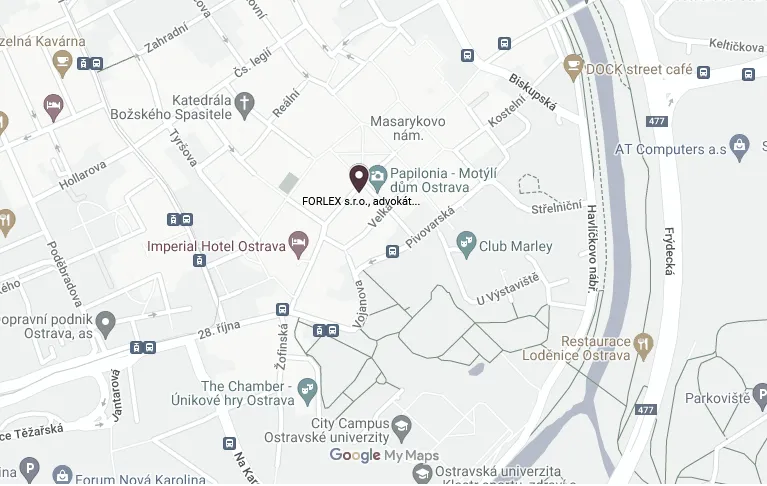

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

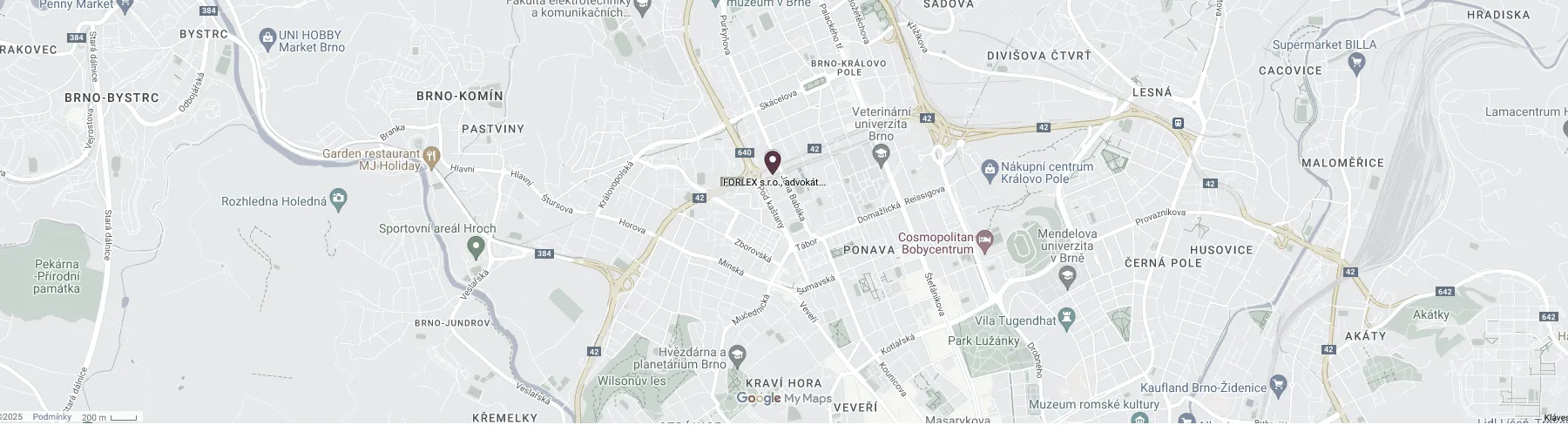

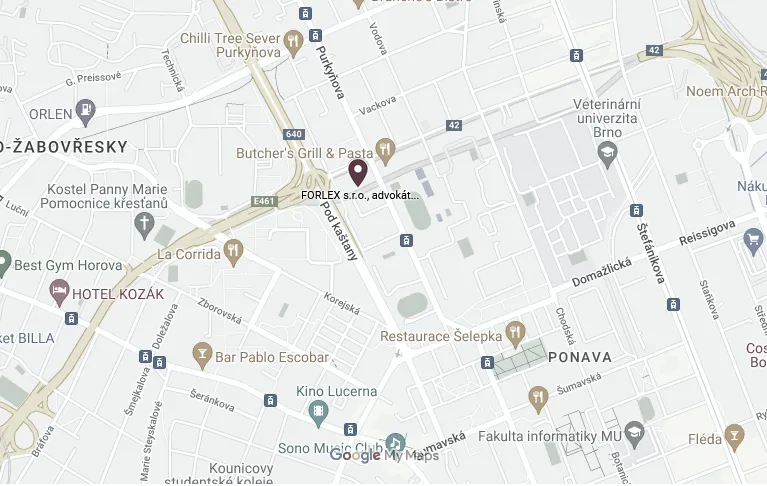

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.