Our team

IVAN BARABÁŠ, JUDR., ING.

Attorney, Partner

BIO

Ivan Barabáš is a founding partner of FORLEX with more than twenty years experience providing legal services to clients including leading international and Czech corporations, investors and private businesspeople. Ivan Barabáš specializes in mergers & acquisitions, corporate insolvency & restructurings, and also in specific issues within the area of banking & finance. In his long-term legal career, Ivan Barabáš has also advised clients on wealth management, directors’ liability, forensic and legal due diligence, energy law and professional services matters.

In M&A, Ivan Barabáš has participated in many important transactions on the Czech market, particularly in the financial services, energy, manufacturing, automotive, IT and professional services sectors. In corporate insolvency & restructuring, Ivan Barabáš focuses on out-of-court restructuring programs and reorganizations. In banking & finance, Ivan Barabáš has extensive experience with block sale of claims, factoring and other forms of receivable-based financing, financial restructurings and acquisition financing.

Before establishing FORLEX, Ivan Barabáš worked for more than ten years at Havel, Holásek & Partners. Since 2011, he worked for Havel, Holásek & Partners in the position of a co-managing partner responsible for its branch in Ostrava. In 2010, Ivan Barabáš was seconded to the leading Dutch law firm De Brauw Blackstone Westbroek in Amsterdam, the Netherlands. Prior to joining Havel, Holásek & Partners, Ivan Barabáš also worked for the Prague branch of the Austrian law firm Wolf Theiss and also for the ČSOB financial group.

SPECIALIZATION

- Mergers & Acquisitions

- Corporate law

- Banking & finance

- Insolvency & Restructuring

- Commercial law

- Private clients

PROFILE TRANSACTIONS AND ADVISORY PROJECTS

- Local legal support to a Brno-based provider of predictive analytics and IT operations automation services in connection with its sale to an international holding company

- Comprehensive advisory services to a group of individuals on the sale of a specialised glass technology company (and its subsidiaries in the US, UK, Germany, China, Slovenia and Croatia) to a multinational strategic investor

- Comprehensive advisory services to a Brno-based client on the sale of selected assets and its project team to a multinational petrochemical group

- Representing a German automotive group in the sale of a project for the construction of a production hall, including partial issues of obtaining an EIA decision and settlement of pre-emption rights in favour of the municipality

- Ongoing advice to a power balance services company in the implementation of their projects involving the commissioning of generation and back-up resources in various locations and involving a range of legal steps, including entering into lease agreements with landowners, lease agreements in relation to generation facilities and aggregation agreements with aggregators of ancillary services

- Comprehensive advice to financial and strategic investors on regular acquisitions of biogas plants and other energy sources in the Czech Republic, including legal review of acquired assets and negotiation of acquisition and financial documentation

- Representing a Czech company in the sale and licensing of intellectual property of the world's leading producer of computer chips

- Comprehensive advice to the sellers on the sale of 100% of book-entry shares in a company providing computer network security services to an US investor

- Legal support to management in the process of selling a company to a private equity fund, including setting up a management incentive program and negotiating a shareholders’ agreement

- Representing owners of various medical facilities on several sales to strategic and financial investors, including advice with respect to applicable regulatory aspects in the healthcare sector

- Advising a leading Austrian financial group on a number of acquisitions in the Czech Republic, including comprehensive legal advice regarding acquisition of a part of a bank’s retail business and acquisition of a home building savings bank operating in the Czech market

- Advising a Czech based advanced solutions supplier in the field of glass melting, conditioning and forming on its acquisition of targets abroad, including legal support to the client’s foreign operations following the acquisition

- Advising foreign investors on purchase of non-performing loan portfolios from the Czech Consolidation Agency and Czech banks, including advice on financing aspects and subsequent NPL servicing of the portfolios

- Advising top executives of leading Czech banks on directors’ liability and corporate governance matters

EDUCATION

- Charles University, Faculty of Law, Prague (2002), Mgr. (Master of Laws)

- Universiteit Utrecht, Faculty of Law, Utrecht (2002)

- Charles University, Faculty of Law, Prague (2004), JUDr. (Doctor of Laws)

- University of Economics, Faculty of International Affairs, Prague (2005), Ing. (Master of Economics)

LANGUAGES

Czech, English

MEMBERSHIP IN PROFESSIONAL ASSOCIATIONS

- Czech Bar Association

- INSOL Europe

VCARD

Get to know us

More teams members

IVAN BARABÁŠ, JUDR., ING.

Attorney, Partner

Ivan Barabáš is a founding partner of FORLEX with more than twenty years experience providing legal services to clients including leading international and Czech corporations, investors and private businesspeople...

Whole BIO

PAVEL ŘÍHA, MGR.

Attorney, Partner

Pavel Říha is a founding partner of FORLEX with twenty years of practice in the field. He specializes in corporate law, acquisitions, divestitures and transformation of companies and insolvency and restructuring.

Whole BIO

LENKA NĚMCOVÁ, MGR.

Attorney, Partner

Lenka Němcová is a partner of FORLEX. She specialises in real estate and construction law, public law, general commercial law and corporate law. Lenka Němcová also advises in the field of acquisitions and divestitures.

Whole BIO

EVA OSTRUSZKA KLUSOVÁ, MGR., LL.M.

Attorney, Partner

Eva Ostruszka Klusová is a partner at FORLEX with more than 15 years of experience in providing legal services. She specializes in labour, healthcare and pharmacy law. She also advises clients in the field of commercial law and provides services to French speaking clients.

Whole BIO

JAKUB DOSTÁL, MGR.

Attorney

Jakub Dostál is an attorney at FORLEX. He focuses primarily on corporate law, mergers & acquisitions, energy law and the law of obligations. Jakub Dostál joined FORLEX in 2021 as an associate and from 2024 as a permanent associate.

Whole BIO

LUKÁŠ MAREK, MGR.

Attorney

Lukáš Marek is an attorney at FORLEX. He specializes primarily in providing legal support for business corporations and M&A transactions. Lukáš Marek also provides counselling in contract law and business relations.

Whole BIO

ROBERT SIKORA, MGR.

Attorney

Robert Sikora is an attorney at FORLEX. He focuses primarily on corporate law, mergers & acquisitions, and contractlaw. In the field of corporate law, Robert Sikora focuses on the day-to-day operation and management of business corporations...

Whole BIO

MARTIN ŠLAMPA, MGR.

Attorney-at-law, registered mediator

Martin Šlampa is an attorney at FORLEX. He specialises in litigation and is a registered mediator. He represents clients in a wide range of commercial disputes as well as in administrative proceedings and proceedings before administrative courts.

Whole BIO

DOMINIK ŠOLC, MGR.

Attorney

Dominik Šolc is an attorney at FORLEX. He specializes mostly in contract law and mergers and acquisitions.In the field of contract law, Dominik Šolc focuses on commercial contracts concerning information technology.

Whole BIO

KAMILA FIŠEROVÁ ULRICHOVÁ, MGR.

Attorney

Kamila Fišerová Ulrichová is an attorney at FORLEX. She focuses primarily on real estate law, administrative law, personal data protection and compliance, and also advises in the field of labour law. In the field of real estate, Kamila Fišerová Ulrichová has provided comprehensive legal advice on drafting...

Whole BIO

SIMONA ZAHRADNÍČKOVÁ, MGR.

Attorney

Simona Zahradníčková is an attorney at FORLEX. She specialises in labour law, corporate law, and mergers & acquisitions. She also provides services to French speaking clients. In the field of labour law, Simona Zahradníčková specializes particularly in coverage of HR areas in the legal field, illegal employment issues and labour law due diligence.

Whole BIO

ŠTĚPÁNKA KOČAŘOVÁ, MGR.

Associate

Štěpánka Kočařová is an associate at FORLEX. She focuses primarily on contractual relations and general contract law, real estate law, IP/IT rights, compliance and whistleblowing. Among others, she also consults on employment law, especially in the field of job placement and employment agencies and specialises in family law.

Whole BIO

VOJTĚCH HOFÍREK, MGR.

Associate

Vojtěch Hofírek is an associate at FORLEX. He specializes primarily in general civil law, such as contracts and property rights, litigation, corporate law and general and specific administrative law, especially in the field of real estate and related areas.

Whole BIO

DAVID JUCHELKA, MGR.

Associate

David Juchelka is a graduate of the Master's degree programme in Law and Legal Science at the Faculty of Law of Masaryk University in Brno, which he successfully completed in 2024 with the Final state exam.

Whole BIO

ONDŘEJ KADERKA, MGR.

Associate

Ondřej Kaderka is an associate at FORLEX. He specializes primarily on contractual relations and general contract law, as well as general and specific administrative law, particularly in the areas of real estate and arms industry.

Whole BIO

KATEŘINA KUPCOVÁ, MGR.

Associate

Kateřina Kupcová is a graduate of the Master's degree programme Law and Legal Science at the Faculty of Law of Masaryk University in Brno, where she successfully passed the Final state examination in 2022.

Whole BIOLegal services in CZ, SK and abroad

Contact

info@forlex.cz

+420 596 110 300

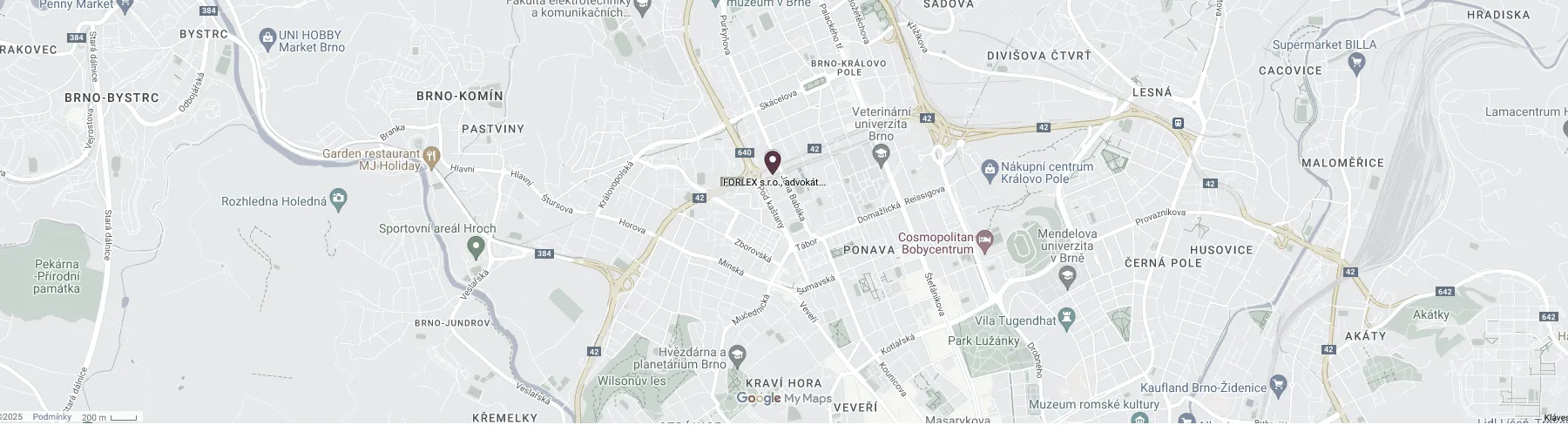

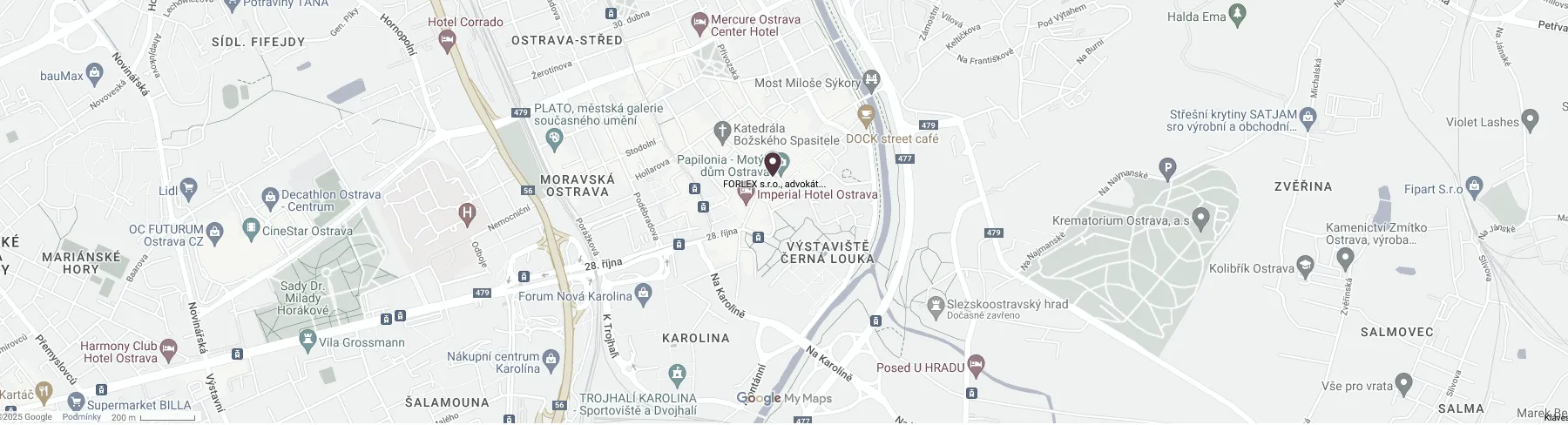

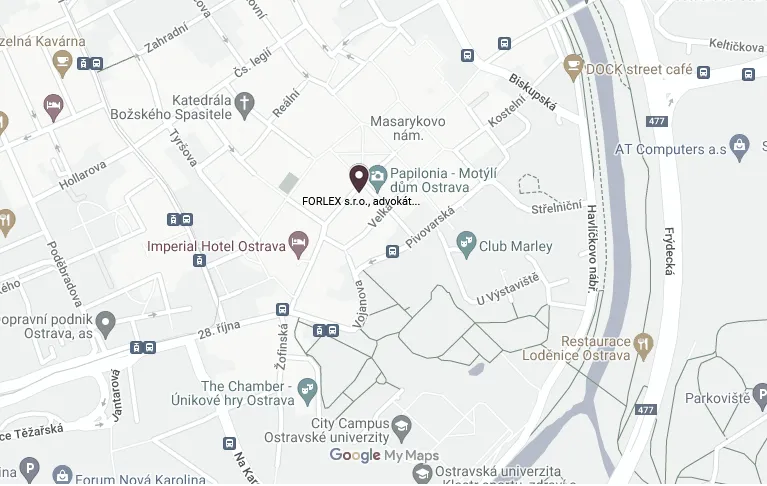

Ostrava

FORLEX s.r.o., attorneys-at-law

28. října 3159/29, 702 00 Ostrava

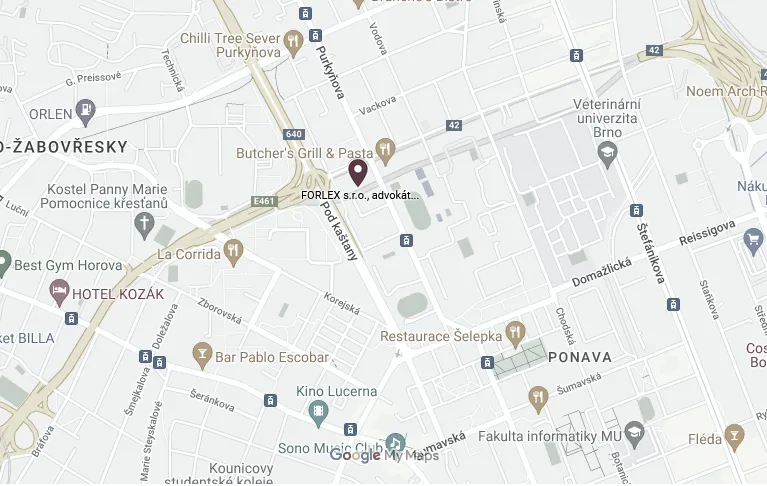

Brno

FORLEX s.r.o., attorneys-at-law

Jana Babáka 2733/11, Královo Pole, 612 00 Brno

Billing information

IČO: 04275705, DIČ: CZ 04275705

ČSOB

Account No. CZK – 321695472/0300

Account No. EUR – 333568649/0300

Registred in the Commercial Register maintained by the Regional Court in Ostrava, Section C, File 63028.

Consumer protection information

On 5 February 2016, the Czech Bar Association was authorized by the Ministry of Industry and Trade of the Czech Republic to deal with alternative consumer dispute resolutions in the field of disputes between a lawyer and a consumer arising from legal service agreements (under Act no. 634/1992 Sb., on consumer protection, as amended). The website of the designated body is www.cak.cz.